Green and Sustainable financing options for universities

UK universities are making commitments to lead the response to climate change and reduce their environmental impact by implementing net-zero carbon strategies. The capital investment required across the sector is significant, but the business case is enhanced by the opportunity to mitigate rising energy costs and there are various funding options available.

What is “Sustainable Finance” and why is it important?

The first ESG debt issuance in the capital markets by a UK university was King’s College London’s £125m Sustainable Private Placement (“PP”) in March 2021, supported by QMPF. We also advised the University of Hull on its £86m Green PP in May 2022, which was another first for the sector. Other activity has included UCL’s £300m Sustainability Bond, the London School of Economics’ £175m Sustainable PP and most recently the issue of a ‘Sustainability-linked’ PP by the University of Derby. These terms are subtly different and are explained below.

Despite difficult macroeconomic conditions and a general slowdown in debt capital market issuances over the last two years, global green issuances have been forecast by the Climate Bonds Initiative to hit a cumulative $5tn by the end of 2023. Funders have increasingly built ESG-related criteria into their investment decisions, so structuring an opportunity as green or sustainable can maximise potential interest from the debt market.

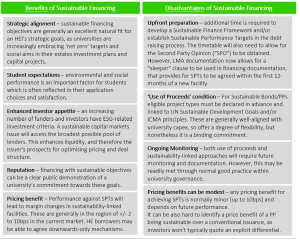

A comparison of the main approaches:

Sustainability-linked loans can refer to any debt or loan facilities which incentivise the borrower’s progress towards sustainability-focused objectives. The borrower’s performance is measured against Sustainability Performance Targets (“SPTs”) over the life of the facility, leading to changes in debt pricing. Loan Market Association (“LMA”) guidance suggests that the SPTs selected should be material and address relevant environmental, social or governance challenges that are of strategic significance to the issuer. We have recently arranged sustainability-linked bank facilities for the University of Essex and Manchester Metropolitan University, which included SPTs linked to carbon emission reductions and social access objectives.

By contrast, Sustainability or Green Bonds (including private placements) are arranged on a ‘use of proceeds’ basis, which requires that the funding raised is allocated towards specific project types that contribute towards green and/or social objectives. These approaches are compared below:

Is there a risk of these funding approaches being seen as “greenwashing”?

Yes, this is a risk, as the ESG aspects of any such debt issue will likely be in the public domain and therefore need to stand up to scrutiny (particularly from students!). In our experience, sustainable financing is most effective when based authentically upon a university’s underlying strategy and is considered early in the funding process. Developing a robust capital expenditure plan, which includes projects with genuine green or social impacts, is a helpful foundation.

The credibility of ESG financing can also be enhanced by following principles set out by the International Capital Markets Association (ICMA) and Loan Market Association (LMA). These recommend publication of a Sustainable Finance Framework. This framework sets out the borrower’s ESG-related objectives with a protocol for managing the deployment of funds (if relevant) and monitoring performance. Best practice also recommends external review of the framework by an independent Second Party Opinion provider, such as Sustainalytics, S&P or DNV, among many others. Once a Sustainable Finance Framework is published, it enables the borrower to issue a range of sustainable debt instruments through the strategy and process it sets out.

What other funding approaches are available for energy-related projects, as an alternative to direct external borrowing?

Renewable energy projects can also be delivered through project finance and other contractual structures. These can be deployed to leverage third-party investment into university campuses, which in the right circumstances can be on an “off-balance sheet” basis for the university. Funding structures include:

- Energy Service Companies (“ESCOs”): Standalone companies that provide energy services, including the design, implementation, and financing of energy-generation or efficiency projects.

- Energy Performance Contracting (“EPC”): an agreement based on energy usage and savings, which often delivers retrofits or energy efficiency measures. An energy service provider (ESP) will design, finance and implement the improvements – in return being paid from the energy savings it generates. It may involve some loss of control of asset operation.

- Power Purchase Agreements (“PPAs”): an agreement for the purchase of energy from a generator, at a fixed price. Can be structured for on or offsite renewables. They are attractive to both sides – as a university PPA will help underpin revenue projections for the operator.

- Leasing: asset finance for less integrated equipment, such as solar PV or heat pumps. A wide range of contract lengths and terms are available.

The benefits of these structures can include:

- Access to alternative funding sources

- Reduce impact on the university balance sheet (depending on the contract structure)

- Engaging specialist expertise of energy providers

- Risk transfer

- Fixed energy costs – decoupled from future utility market movements.

If you would like to discuss any aspects of this article and whether these funding approaches might suit your circumstances, please get in touch with our team on the details below.

A selection of our recent experience:

Links:

Kings’ College, London – Sustainable Finance Framework

University of Hull – Green Finance Framework

Glossary

ESCOs – Energy Service Companies. ESCOs are standalone companies that provide energy services to clients, including the design, implementation, and financing of energy-generation or efficiency projects.

EPC – Energy Performance Contracting. An agreement based on energy usage and savings, which often delivers retrofits or energy efficiency measures.

“ESG” factors – Environmental, Social and Governance (ESG) refers to the three central factors commonly used when assessing the sustainability of a business’s activities or an investment.

Climate Finance – is financing that supports the transition to a climate resilient economy by enabling mitigation actions, especially the reduction of greenhouse gas emissions, and adaptation initiatives promoting the climate resilience of infrastructure as well as generally of social and economic assets.

Green Finance – is broader than Climate Finance in that it also addresses other environmental objectives such as natural resource conservation, biodiversity conservation, and pollution prevention and control.

Social Finance – supports actions mitigating or addressing a specific social issue or achieving positive social outcomes. Project categories can include: providing affordable basic infrastructure, access to essential services (like healthcare), affordable housing, employment generation, food security, and socioeconomic advancement and empowerment.

Sustainable Finance – incorporates climate, green and social finance (as defined above).

Green Bond – is a fixed income instrument, where the debt proceeds raised are used to fund green projects.

Greenwashing – is the practice of seeking to gain an unfair competitive advantage by overstating or overemphasising the extent to which an investment or business’s practices are green or sustainable.

ICMA – International Capital Markets Association. The ICMA is a global self-regulatory organisation and trade association for participants in the capital markets. It is a not-for-profit association, which publishes extensive guidance on green, social and sustainable finance principles and best practice. https://www.icmagroup.org/

KPIs – Key Performance Indicators, a quantifiable measure of performance over time for a specific objective.

LMA – Loan Markets Association. The LMA assists in the development of the secondary loan market in Europe. It aims to promote industry best practices and standard documentation. https://www.lma.eu.com/

PPAs – Power Purchase Agreements. An agreement for the purchase of energy from a generator, at a fixed price.

Private Placement – the sale of bonds to pre-selected investor and institutions rather than publicly on the open market.

Public Bond – a publicly-issued capital markets debt instrument, which will generally carry a fixed rate coupon. Within the UK HE sector, public bond issuance is generally preferred for issue sizes of £250m and above and will require the issuer to obtain an external credit rating.

RCF – Revolving Credit Facility. A flexible funding solution that enables the borrower to withdraw and flexibly prepay credit when required, in line with terms and funding limits agreed.

SPO – Second Party Opinion. An independent evaluation of a debt instruments framework’s strength and alignment with accepted market principles.

SPT – Sustainability Performance Targets. Predefined tests, or KPIs, to capture improvements in the borrower’s sustainability profile, which are normally based on objective metrics or external ratings.

Sustainability-linked – can refer to any types of debt or loan facilities which incentivise the borrower’s progress towards sustainability-focused objectives.

Sustainable Bonds – requires that the funding is allocated towards specific project types which contribute towards green or social objectives.

Sustainable Finance Framework – sets out how the borrower plans to invest the proceeds in line with its objectives and monitor compliance and progress in future.

UN Sustainable Development Goals – are a set of 17 global objectives established by the United Nations in 2015, as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. These goals are often used as a blueprint to demonstrate social, economic and environmental impacts within strategic plans and sustainable financing.

More News…