Approaches to Developing a Treasury Strategy

Historically, a treasury strategy has been seen as another piece of governance reporting that adds little on top of wider financial forecasting. As clients face increasingly volatile financial markets, the importance of a treasury plan that includes robust forecasts, clear analysis and detailed outcomes has risen up Board agendas.

Do you need a ‘route map’ for treasury strategy reporting?

QMPF supports a range of clients, both for individual treasury engagements and as retained treasury advisers. That experience has provided a number of simple lessons for developing an approach to treasury strategy communication that delivers Boards valuable information but also allows for efficient implementation.

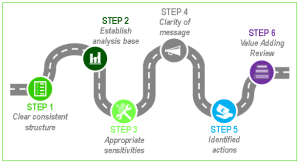

In our experience, the simple steps outlined below, and undertaken in line with your reporting schedule can realise these objectives:

Where to start: a clear structure

While individual circumstances might require additional areas of commentary or appendices, the basic structure below can offer broad headings through which a Treasury Strategy can deliver appropriate assessment and clear actionable messages. Some clients adapt this to reflect wider sectoral or regulatory guidance, but adopting a consistent structure allows for comparability of reporting by the key audiences and minimises the need to ‘reinvent the wheel’ every time the Treasury Strategy is updated. The analysis base can then be built to reflect the consistent structure and produce tables, graphs or other data representation in your report.

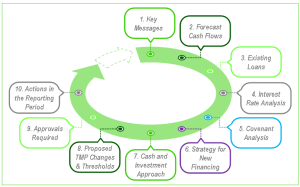

We typically see a structure broadly aligned with:

- Key messages: Effectively an ‘Executive Summary’, this sets the context from the more detailed analysis and highlights where focus is required.

- Forecast cash flows: Forecast monthly cash flows for the next financial year, and relevant cash flow analysis matching the corporate long term budget horizon (on an appropriate frequency basis). Often this reflects a 5 or 10 year horizon, but for some organisations, such as Housing Associations this can extending out to 30 years or beyond.

- Existing loans: maturity ladder covering terms, interest basis, repayment, other relevant features.

- Interest rate analysis: rates, variable rate exposure etc.

- Covenant analysis: basis, calculation, headroom and commentary.

- Strategy for new financing: typically covering the forecast period:

| o Sources;

o Timing; o Proposed maturity; o Anticipated interest basis; o Resulting variable rate exposure; |

o Any hedging or other control over interest rates applying;

o Analysis of maturity ladder resulting; o Measures of forecast indebtedness (and any security position applying). |

- Cash and investment approach:

- Approach to managing cash (and relevant instruments used) for:

- Strategy to manage working capital;

- Management of cash held to meet strategic objectives / contingencies; and

- Other cash held (including foreign exchange considerations and risk management)

- Cash metrics and limits consistent with Treasury Management Policy (e.g. minimum liquidity thresholds, minimum/maximum cash held on notice etc.)

- Wider investment management approach

- Approach to managing cash (and relevant instruments used) for:

- Proposed Treasury Management Policy changes and TMP threshold changes

- Approvals required

- Actions in the reporting period

Where delivered in an engaging and visual format, a consistent and complete structure makes the treasury strategy more accessible and encourage good quality oversight and interaction.

Consistent and efficient: Building an analysis base

QMPF encourages clients to adopt a consistent structure and develop analysis and input data that is similarly constant manner. We assist clients in considering available data, required outputs or dashboard approaches, and looking to automate reporting that flow from that.

An underlying document, or suite of files, with consistent inputs and ‘buy-in’ from across the organisation has huge value:

- tables can be automatically generated;

- visual data is quickly generated; and

- variances and movements are clearly flagged.

This does rely on strong review, ownership and controls processes with file(s) developed to meet good financial modelling practices, but drives efficiency.

In our experience, this also enables review and allows more time to be spent considering the consequences of the resulting outputs and developing the strategy further.

QMPF’s Treasury Dashboard is available to clients and offers a Power BI driven data visualisation, reflecting our view that effective presentation of treasury analytics can aid understanding, drive value, and be more efficient.

Managing the risks: Concise, appropriate sensitivities

Clarity in base assumptions and outcomes allows for appropriate focus on potential treasury risks. These will be bespoke to your organisation, reflect the nature of the underlying business and its financing but must also reflect macro economic conditions, or sectoral concerns.

Your treasury strategy sensitivities should reflect these risks. Additionally, you may have specific sensitivities required by funders, regulators or other stakeholders.

A key question that often arises is: what sensitivity variance should be considered?

QMPF’s approach incorporates regular challenge on hat represents appropriate sensitivities. Questions to consider could include:

- Does each sensitivity reflect current economic forecasts or volatility?

- Are sensitivities just a repeat of prior year and do they fail to reflect increased uncertainty or current business conditions?

- How do peers consider sensitivities?

- Are there any specific aspects of concern for funders/regulators?

- Where there are specific aspects that might impact, for example, covenant compliance, is a ‘breakeven’ sensitivity (the required change to result in breach) appropriate or informative?

- Has a combined downside been considered? Inputs rarely move in insolation.

This needs to be balance with sensitivity outcomes that lack focus and dilute value. QMPF has worked with clients to balance this, often by using the sensitivity data to display outcomes visually, so retaining clarity and impact.

Making an impact: clear, easily absorbed messages

Base case and sensitivity analysis only adds value where there are clear outcomes and messages for stakeholders. This includes clarity on:

- Base case expected outcomes;

- Required actions; and

- Mitigation strategies / alternative approaches in the event that up or downside sensitivities arise.

Update and evolve: regular review

Frequently we see clients with repetitive approaches to treasury strategy. It becomes ‘just another reporting requirement’ rather than a tool to manage risk and maximise value.

External challenge and annual review can assist, offering a fresh perspective and allowing for development. A few mechanisms can be considered here including:

- Feedback from stakeholders: this can assist in honing messaging and making the content more easily absorbed.

- Annual treasury review: informs where variances from forecast arose in prior years and points to aspects of business planning and sensitivity that may have been overlooked.

- Learning from others: considering approaches used by other similar organisations and whether they offer improved insight, clarity or brevity.

- Third Party Support: before completion of your strategy, obtaining an independent, third party view on the approach. A ‘critical friend’ can enhance your document.

How we can help

QMPF supports a range of clients, particularly in the higher education and social housing sectors, in considering treasury management issues. We frequently assist clients who are producing treasury strategies by offering independent review, developing a base analysis template, critique of sensitivities, review against best practice, considering peer comparators and acting as a critical friend. Let us know if we could support you.

Combined with a long-standing sector understanding, we offer retained treasury management advice, treasury management reviews, debt options appraisals and support clients raising and refinancing debt in both the bank and capital markets. Our services include:

If you are reconsidering your treasury management approach, would like more information on the matters discussed above or have a need for corporate finance support we would be delighted to speak to you.

More News…