Balancing return, risk and liquidity: options for cash management

Balancing return, risk and liquidity: options for cash management

Pressures on operating costs and revenues, as well as an interest rate environment that is fundamentally different from the past decade has seen many finance directors and treasury managers re-evaluate options for cash and cash equivalents. What factors and options could you be considering?

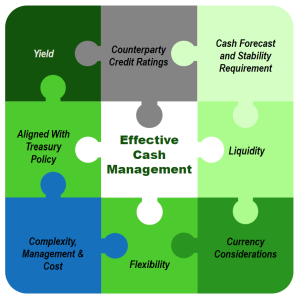

Recognise that it is a unique puzzle

Consideration of cash management options are like a jigsaw, but the puzzle is unique to your organisation. It is critical that a strategy is developed to recognise your specific circumstances. The framework you develop needs to be based on a detailed consideration of financial position, cash requirement forecast and treasury policy constraints.

Understanding your cash forecast and the options available

The initial step in progressing a cash management strategy should be to develop confidence in the cash flow forecast, and sensitivity of this. Historic analysis of the variance of cash position from forecast, over a series of timeframes, can help treasurers appreciate the ‘realism’ of forward looking sensitivities. In turn, that allows you to evaluate the flexibility that needs to be built into your cash management strategy.

This can also be used to establish your ‘primary’, ‘secondary’ and ‘tertiary’ cash requirement: essentially splitting your cash requirement into:

- Primary: immediate cash requirement, prioritising immediate liquidity and stability over yield – matched to your operational cash requirement.

- Secondary: less than 12 month horizon, potential short duration strategy balanced with preservation of capital – matched to your core cash requirement.

- Tertiary: an element that is extremely low volatility, where the holding is almost indefinite and where you might consider reduced liquidity in return for yield – matched to your strategic cash requirement.

From this standpoint, the extent to which stability and liquidity might be ‘traded’ for yield can be considered for each tier of cash resources.

This analysis and the inherent ‘trade off’ needs to be addressed within your governance structure and the flexibility available to the treasury function may need to be reviewed. Increasingly we see clients driven to reconsider this flexibility because of the scale of cash resources now available (and that the realisable return from cash and cash equivalents is now more material) and every little helps when income or operating costs are under pressure.

Diversification and counterparties

The development of a cash management strategy also provides the opportunity to reassess and better manage counterparty and concentration risk, putting policies in place to limit and diversify these. It also affords an opportunity to consider if your cash management strategy is aligned to wider ESG strategies.

In Q2 2023, Treasury Management International and Northern Trust Asset Management surveyed 217 corporates. The survey revealed that 18% of the treasury teams held 80%-100% of their short term investment portfolio in bank deposits and 14 held 60-79% of

their short-term investment portfolio in the same instrument. The lessons from the 2007-2008 financial crisis are perhaps fading, which is perhaps surprising in light of high profile banking sector collapses in the past 12 months, including SVB and Credit Suisse.

In our opinion, a cash management strategy should consider your:

- Counterparty risk policy: limiting the individual institution exposures you have and establishing the maximum individual exposures with reference to relevant credit rating assessments.

- Investment policy: with consideration of deposit limits that recognise the nature of deposits and links between institutions, and effectively reduce concentration risk.

- Ongoing monitoring: developing an approach to monitoring counterparty risk changes, both through monitoring credit ratings and considering other metrics, such as credit default swap rates.

What options are there?

While they may not suit your specific circumstances or currently align with your treasury management policy, there remains a number of options to consider in allocation of cash resources:

- Cash Accounts: the core route to retaining liquidity, easily understood and offering absolute flexibility. Regular benchmarking of the services and rates offered remains worthwhile.

- Term Deposits: available on a wide range of durations, most typically out to 3 years, but can be arranged on longer maturities. Can include multiple durations. The interest payment timing and exceptional circumstance withdrawal conditions can vary.

- Direct Gilt Holdings: available both directly (where pre-approved by the Debt Management Office (“DMO”) as members of the Approved Group) or purchased in the secondary market via an intermediary.

- Money Market Funds (“MMFs”): available from a range of financial institutions via intermediaries. Treasury managers may consider a range of MMF maturities (short term and standard) and underlying investment criteria (e.g. public debt constant net asset value (“CNAV”) MMFs vs low volatility NAV (“LVNAV”) MMFs). It is therefore important to understand the specific nature of the individual MMF’s being considered, the relative issued ratings (which are specific to MMFs) and the relative return expectation, net of fees. MMFs can offer inherent diversification and expectation of liquidity (subject to understanding of the ultimate liquidity risk related to the MMF).

- Ultra short bond funds: Can match the cash management requirements of clients with a longer investment time horizon, and more flexibility in underlying credit rating, while still offering high levels of liquidity (e.g. T+1 access).

- Other direct holdings: typically requiring internal resources with expertise in analysis and selection of relevant investments, so less often utilised. These could include commercial paper, asset backed commercial paper, floating rate notes etc.

Clients will also have a number of other considerations; for example, managing reinvestment risk by staggering maturities, considering ESG linkages and managing any foreign currency requirements. A bespoke approach is almost always required.

Evaluate your debt positions and products

In addition to considering the options available, we always advise clients not to consider cash resources in a vacuum. Where you have excess liquidity, consider options to pay down debt. This may require taking a longer term view and having a clear understanding of the potential costs, loss of flexibility and accounting associated with any repayment.

Similarly, where revolving credit facilities (“RCFs”) are in place, consider how these are utilised (or not) and any limitations on frequency of drawdowns and repayments.

A related consideration might be whether you are maximising the value of your existing banking relationships – for example. we frequently see banks offering improved debt margins where there is a transfer of your transactional banking.

Enabling options and develop a strategy

Having developed an understanding of the options available to you it may be necessary to revisit your Treasury Management Policy to consider whether the approach is already compliant, or if you would need to gain governance approval for changes to access other options. Making any changes to a Treasury Management Policy requires consideration of sector guidance and ensuring the relevant Board or sub-committee understands the implications and benefits of any changes. A revised strategy can then be proposed and delivered.

Where the range of assets held broadens, the extent of management and monitoring typically increases and there will likely be an increased requirement to review liquidity requirements and ensure golden rules continue to be met.

Circumstances change

As referred to above, processes need to be in place to monitor treasury requirements. Circumstances change and cash requirements, absolute returns available, relative returns available and risk positions change. A more dynamic approach to cash management will likely require enhanced monitoring, data to enable this, and more frequent management.

How we can help

QMPF supports a range of clients, particularly in the higher education and social housing sectors, in considering treasury management issues.

Combined with a long-standing sector understanding, we offer retained treasury management advice, treasury management reviews, debt options appraisals and support clients raising and refinancing debt in both the bank and capital markets.

If you are reconsidering your cash management approach, would like more information on the matters discussed above or have a need for wider treasury management support we would be delighted to speak to you.

More News…