Financial Sustainability in Larger Higher Education Providers: Reflections from the BUFDG Annual Meeting 2025

Financial Sustainability in Larger Higher Education Providers: Reflections from the BUFDG Annual Meeting 2025

The UK Higher Education (“HE”) sector continues to face financial headwinds driven, in part, by limited increases in domestic tuition fees, volatility international recruitment and inflationary pressures. The May 2025 Office for Students (”OfS”) financial sustainability report highlighted that 45% of providers are expecting an operating deficit in FY24/25, with many universities announcing redundancy and restructuring programmes to improve their financial position.

QMPF recently held a practical workshop at the British Universities Finance Directors Group (“BUFDG”) annual meeting, which was attended by around 40 finance leaders from the UK’s larger Higher Education Providers (“HEPs”) to explore the pressing challenge of financial sustainability. Facilitated by QMPF, the session was designed as a practical, interactive forum to share experiences, test radical ideas, and identify actionable strategies to improve cost efficiency and revenue generation. The discussions were candid, energetic, and grounded in the realities of a sector navigating financial challenges.

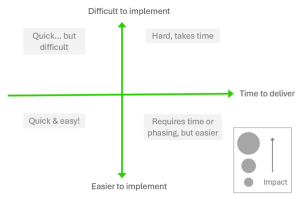

Risk and Execution Matrix

The session was framed around a ‘risk and execution matrix’ allowing participants to consider options available against the difficulty of implementation, time to deliver and the scale of their potential impact.

A sector beyond quick fixes

A sector beyond quick fixes

A clear consensus emerged early in the session: the era of “quick wins” is over. Most institutions have already implemented basic cost-saving measures, cutting discretionary spend, reducing travel, and tightening procurement. What remains are the more complex, systemic levers that require time and strategic consideration to pull.

Participants highlighted estates, workforce, and academic portfolios as the most significant areas for potential savings, but also the most difficult to change. Estates, in particular, were seen as underutilised, with a call to reimagine campus footprints in light of evolving hybrid teaching models. Yet, decisions around estate optimisation are difficult, shaped by different ownership structures, locations, and the long-term vision of each institution.

Workforce rationalisation was another recurring theme. Legacy contracts, pension obligations, and sector-wide pay agreements continue to be challenging. While some institutions are exploring outsourcing or contractual changes, these approaches remain nascent and fraught with reputational and operational risks.

Radical Thinking: The “Department of University Efficiency”

To provoke fresh thinking, participants engaged in a thought experiment: what if Elon Musk were appointed COO of a university with a mandate to increase net operating cashflow? The resulting “Department of University Efficiency” (DOUE) surfaced a provocative set of ideas, some tongue-in-cheek, others plausible.

While many of these ideas would be politically challenging, the exercise underscored a key insight: the sector’s current constraints—governance, regulation, stakeholder expectations—limit the range of viable financial strategies. When finance leaders are able to explore ideas without the current sector’s constraints, the option set expands dramatically.

Revenue & Cash Generation: Opportunities and Limits

On the revenue and growth side, the conversation was more cautious, reflecting the competitive recruitment landscape for domestic and international students. While international partnerships, transnational education, and asset monetisation (e.g., sale and leaseback of assets) were seen as promising, participants acknowledged the complexity, management effort and long lead times involved. Philanthropy was cited as a successful strategy for some institutions, but not universally replicable.

Importantly, there was a shared recognition that not all commercial ventures are worth pursuing. In some markets, activities like summer lettings or conferencing may yield limited returns. The message was clear: focus matters. Institutions must be selective, aligning revenue strategies with their unique strengths and market positions.

Final Reflections

The session was a timely and thought-provoking exploration of the financial crossroads facing larger HEPs. It revealed a sector that is pragmatic, collaborative, and willing to face the sector’s financial challenges. While there are no silver bullets, the session affirmed that with shared insight, bold thinking, and strategic focus, universities can chart a sustainable path forward.

How can QMPF help?

We can provide support to universities in navigating this environment, evaluating any change opportunities, debt restructuring options and assisting in delivering solutions. Our experience supporting the sector is longstanding and we have good relationships with its primary funders. We can support you through:

- Forecasting and options appraisals: preparation of financial forecasts and models is at the core of our expertise. It is critical that any forecasting to inform decision making is robust, transparent and able to present a range of scenarios. We can assist in development of your forecasts or undertake a review of existing forecasts, acting as a “critical friend”, prior to circulation through internal governance or externally to funders or regulators.

- Lender engagement and covenant negotiation: We have developed strong relationships across banking and capital markets over 20+ years advising in the HE sector, which are maintained through our live engagements. These relationships allow us to have candid discussions with funder contacts and anticipate key credit We believe that a skilled intermediary can help find solutions and reduce the workload of internal finance teams during periods of potentially difficult circumstances.

- Refinancing, re-optimisation and arrangement of new facilities: We are actively supporting various university clients on debt options analysis, covenant negotiations, asset optimisation, repayment of existing borrowing (including benchmarking of hedge breakage gains/costs using Bloomberg) and procurement of new facilities. Our market coverage means that we can provide you with visibility of the full range of refinancing options, including property-based solutions such as income strips.

- Liquidity and Treasury Management: In the current environment it may be prudent to review your wider treasury management policies or benchmark your approach to liquidity. We can provide ongoing strategic and treasury management advice leveraging innovation and technology where possible to facilitate better, more informed strategic decisions.

- Trusted Advisor: We aim to develop long-term client relationships and can act as a trusted advisor, deploying our expertise to assist you in the development of innovative strategies to maintain financial and operational sustainability. We can provide independent challenge, support and guidance in managing governance processes, including project management of the implementation of strategic plans.

More News…