Income Strip Considerations for the HE Sector

An introduction

QMPF has previously produced a general introduction to ‘income strip’ finance which you can find here.

In the Higher Education sector this financing route has gained increasing prominence both through its use in off-balance sheet structures to deliver Design Build Finance and Operate (“DBFO”) student accommodation projects, such as that for University of Staffordshire (Project Detail), and its use for direct fund raising, such as transactions for the University of Lancashire and University of Kent.

The emergence of income strips has partly been driven by the increasingly selectivity of other funders to the HE market, constraints on availability of long-term lending from commercial banks, and the competitive position of income strips when compared to index-linked bond financing for DBFO projects.

With more of our clients considering income strips and an increasing number of providers in the market, we have identified a number of matters universities should contemplate where they are considering this financing route.

How do income strips compare with debt?

Universities have historically used debt to meet funding requirements and deliver long-term investment. Given very restricted availability of long-term commercial bank lending, financing for longer term capital projects tends to be limited to:

- Capital markets funding: private placements or public bonds, which generally pay interest at fixed rate with a bullet capital repayment on maturity;

- Initial use of shorter-term bank lending (including Revolving Credit Facilities) with the need to refinance this in the future; or

- Income strip finance (we are also seeing emergence of secured debt structured with an inflation link, sharing many of the features of an income strip).

More generally, income strip and debt finance also have several different features including:

| Income Strip Finance | Debt Finance | |

| Availability | Internal credit consideration of the HEI combined with an asset assessment drives pricing. There is a growing market of providers. | Limited long-term debt availability. Capital markets provide the most likely route to long term financing. Increasing selectivity on credit quality. Short term debt may be available but refinancing risk would remain (see below). |

| Interest Rate / Refinancing Risk | University is not exposed to interest rate risk or refinancing risk, lease lengths can typically extend to 50 years. | Private placements offer long term fixed rate funding, but fixed rates are high relative to last decade. Short term debt finance can be variable or fixed rate but will expose the University to refinancing risk and future interest rate risk. |

| Inflation Risk | Future lease payment linked to an inflation index, though this can be subject to annual limitations. | Debt does not expose the University to inflation risk. |

| Covenants | No financial covenants.

However, lease payments would typically be considered debt service |

Annual covenant tests, based on debt service cover ratios and leverage. |

| Repayment | No direct ‘repayment’ element but rather incorporated within the lease payment. The asset reverts to the University at lease maturity, typically for £1. | Various options available, for private placements, typically structured as a bullet repayment. Bank debt may include amortisation. |

| Asset availability | The asset in the lease structure is important to the funder. There is a preference towards income generating assets and the funder will consider the underlying asset value when contemplating funding. | May be on a secured or unsecured basis, most typically university debt is on an unsecured basis. |

| Flexibility | Limited, options to break the lease are typically relatively expensive. | Limited flexibility where capital market funded. Other debt may be more flexible but subject to break costs (if on a fixed rate basis). |

| Consents | May still be subject to existing lender and/or USS consents. | May be subject to existing lender and/or USS consents (where secured). |

| Governance | Should review whether existing treasury policy allows for debt raising on this basis. | Subject to lending limitations within existing treasury policy/strategy. |

How might the finance costs compare?

The annual financing cost from structures, and how its varies over its full term (through inflation, interest rate risk or amortisation) is a critical question for HE institutions.

An income strip is based on provision of upfront capital (a “lease premium”) from a funder in return for committing to an inflation-linked series of lease payments. The product is priced based on a ‘net initial yield’, reflecting the initial rent level divided by the upfront capital provided. The lease payment is subject to annual increases to reflect a chosen indexation basis. This may be further subject to a cap and a floor. The lease length, indexation basis and cap/floor levels all impact pricing and are important aspects of deal structuring.

When compared purely on an IRR basis, income strip finance can appear more expensive than equivalent term debt. However, the structure provides benefits of a significantly lower initial debt service costs, wider availability, long-term maturities (with no refinancing risk) and it will not normally include financial covenant tests for the borrower. In current market conditions income strip finance offers:

The main disadvantages of an income strip structure are its relative inflexibility once transacted, and the exposure to inflation-risk on future debt service (albeit this can be mitigated through the cap). The lease payment obligations will also normally be considered within borrowings by financial covenant tests in other debt facilities, so it is important to check relevant drafting and monitor the impact.

We would recommend a full consideration of funding options – which, in addition to pricing, should consider their commercial implications, pros/cons and suitability for your specific circumstances – before embarking on a funding process.

Other considerations

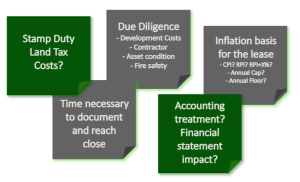

In contemplating an income strip there are a range of wider considerations relevant to HE institutions. These include:

Structuring depends on the funding purpose

While an income strip is a catch all term for long term index linked leases with asset reversion to the borrower, they can be structured in a number of ways.

This is frequently driven by the purpose of the fund raising. Where the project involves development of the asset (or other capital spending on the asset), a number of options exist on how the leases can be structured alongside development finance. Consideration needs to be given to issues including where development risk sits, how works are contracted for, financial diligence on contractors, lease start dates, delay risk, funder step-in rights and long stop positions.

To address these a number of structures have emerged in the market, including where the lenders acts as both funder and developer, inclusion of a third-party developer or the University retaining the development role. Where an income strip is used to raise finance for other general purposes, on an existing asset, these considerations become simpler.

Similar considerations are also likely to apply where an income strip is used within an off-balance sheet structure, for example in a “DBFO” student accommodation partnership. These projects can add further layers of complexity and specialist legal and tax advice is typically taken.

QMPF in the income strip market

QMPF’s income strip experience is long-standing. Our first income strip transaction with a university was with Swansea in 2011 and we supported University of Brighton to finance a DBFO transaction using an income strip over 5 years ago. More recently we supported University of Staffordshire deliver its student accommodation DBFO project, where the DBFO project company is income strip funded. There are also several current projects we are acting on considering this evolving funding option.

More News…